Ever since the Housing Bubble of 2008 imploded, many Austrian economists, authors, and spokesmen have come out to announce that hyperinflation was just around the corner. The concerns of a hyperinflation scenario had much to do with the Federal Reserve’s policy of Quantitative Easing (QE). The Fed had exploded its balance sheet to unprecedented levels since the Great Recession began in 2008-09. Well, where is it and why hasn’t hyperinflation reared its ugly head yet?

Modern Hyperinflation

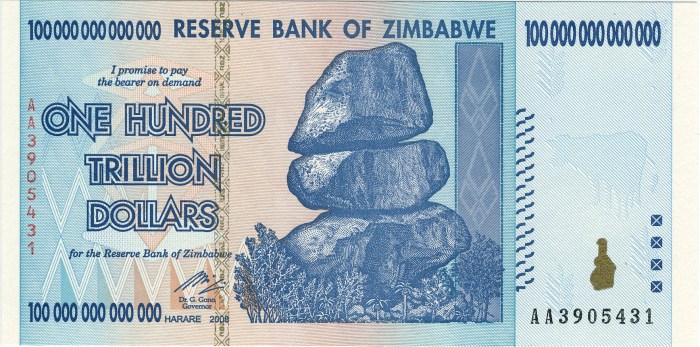

To get an idea what hyperinflation looks like just consider the case of Zimbabwe. The problems began in the 1980s after Robert Mugabe’s socialist Zanu-PF government took the reigns of control during Zimbabwe’s transition from the British-controlled country of Rhodesia, but really accelerated in the 1990s. In the early 90s, Mugabe implemented the Economic Structural Adjustment Program (ESAP) which was designed by the IMF and World Bank. On the surface, the program was to liberalize the Zimbabwe economy, but below view, through a series of large loans and credit facilities, it held large sway over the country’s natural resources and land use rights. To understand more how the IMF and World Bank rape third world economies please check out, “Confessions of an Economic Hitman” by John Perkins.

To add fuel to the fire, the Mugabe socialist government began a program of “land reforms”. Unlike the Bolsheviks in 1918 Russia who stole land from the Cusack’s, Mugabe took land from white farmers and awarded these lands to black “farmers”. As a side note, Hugo Chaves in Venezuela did the same to the private oil industry after he took control. Do you see the running theme here with socialism? But I digress. The new “farmers” lacked any actual agricultural skills so the food supply began to dwindle year after year. The currency printing began. Also, during this same time frame, Mugabe involved himself in financing military conflicts with the Republic of Congo. Even more printing began. The Zimbabwe treasury continued to under-report its war debt to the IMF by some USD $22 million a month. World Bank and IMF loans were also being repaid in inflated currency. The total lack of fiscal restraint by the socialists in power continued into the 2000s. In 1980, at Zimbabwe’s independence, the inflation rate was at about 7%. By the end of 2008, it hit the unbelievable 79,600,000,000%!

Why No US Hyperinflation?

To clear things up, inflation is an increase in the supply of money. The rise in prices is one of the side effects of inflation. So, when this article addresses hyperinflation, it will be the side effect of sky-rocketing prices. Also, not all Austrians or fellow travelers have claimed that hyperinflation was looming any day. But the media has focused on those who have in the past in order to bolster the current inflationary Keynesian economic policies. You would think Peter Schiff, Marc Faber, James Rickards, et al are getting pretty tired of being asked why hyperinflation hasn’t happened yet.

The glaring difference between a Zimbabwe dollar, Reich Mark and US dollar is that the two former currencies weren’t awarded world reserve currency status. Another point is that the US dollar is backed by Saudi oil. World governments have maintained large dollar reserves in order to purchase crude oil from OPEC on the international market. This is something the Nixon administration put into place after Bretton Woods was ended in 1971. In return, the US promises to defend Saudi Arabian interests in the region. Which brings us to the next point, the international US dollar regime is enforced by the US military. This is something Zimbabwe lacks and Germany lost. This is also something Sadam Hussein, Moammar Ghadafi and others who have attempted to exchange oil for money other than in US dollars have found out.

With such influence and firepower to back the US dollar, one can understand how the US government has embarked on a never-ending inflationary policy. The American imbalance of trade with consumer goods producing countries also speaks volumes. By importing goods, say from China, and exporting inflated dollars, the US has had the ability to control domestic inflation by exporting it to her trade partners. As Treasury Secretary, John Conolly put it at the G-10 Conference in Rome in 1971,”It may be our currency but it’s your problem.” This exportation of dollars abroad puts deflationary pressure on the currency, allowing the Fed to monetize government debt with minimal inflationary results. But even this minimal inflation, over the span of decades, has had deleterious results. By some estimates, the dollar has lost 95% to 96% of its original value.

The Era of QE

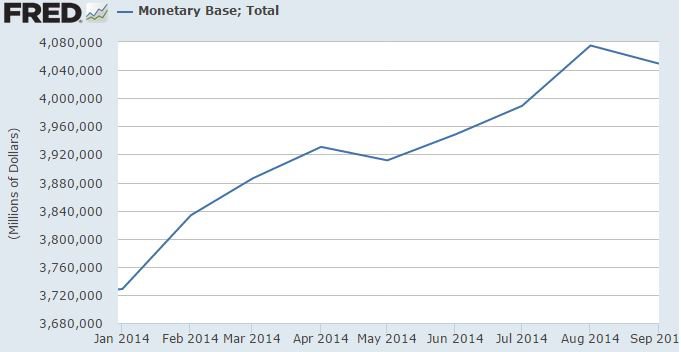

Ever since the Great Recession began in 2008-09, the Federal Reserve has embarked on a series of Quantitative Easing (QE) programs. This is mainstream for monetary inflation. Although the Fed hasn’t actually “printed” paper dollars, it utilized the magic keyboard and created dollars on its ledger. This new currency lays in wait on the Fed’s balance sheet as reserves for the “too big to fail” banks. More precisely, it’s member banks. Some $4 trillion are parked at the Fed since QE started.

Honestly, this could be any amount as idle currency doesn’t affect the economy in any way. This reserve is sequestered away and isn’t being loaned out into the economy at this time. To better understand the mechanics of inflation, refer to the BCE article, “The Snake Oil of Inflation“. This is something the advocates of hyperinflation had missed when Ben Bernanke started QE. Quantitative Easing has been, by all intent and purposes, nothing more than an accounting trick to bolster it’s member banks’ position. It adds the appearance of solvency without the substance. Imagine if these newly created trillions of dollars were ever to get loaned out into the private sector, well, we discussed Zimbabwe earlier.

Giving Credit Where It’s Due

That was the domestic monetary situation. Let us look at the state of the US dollar internationally. As our hyperinflation advocates have pointed out, the trade deficit has put an inordinate amount of dollars out in the world market. Because the US economy has shifted to being service-oriented and not an economy based on production, the American public has had to import most of its consumer goods. This puts an ever increasing amount of dollars, whether in physical paper, treasuries or bonds out in world reserve bank vaults. The important question is how long the rest of the globe will tolerate this imbalance. This author contests that it will last as long as the top players say it will come hell or high water. For, if these players decide they don’t like the game anymore, those dollars will come back home. Large dollar holders will accelerate their purchases of US real estate, companies, and other assets. These dollars will be introduced into the domestic economy and begin the process of raising prices as there will be too many dollars chasing after too few goods.

Secondly, if the world players begin to cash in their bonds and equities any faster than they already are, in other words, create liquidity out of their holdings, then this will spell a loss of confidence in the dollar. It will also spell a loss of its world reserve status. Once that is gone, then it’s game over. With the US government’s ungodly national debt that shows no sign of slowing its rate of growth, the government will have no choice but set out on the Zimbabwe path of hyperinflation to make ends meet. A loss in dollar confidence will only spell increasing interest rates which, in turn, will reveal to policy makers just how dangerous the national debt has been all along. Much to Dick Cheney’s chagrin who once stated that “… deficits don’t matter”. To be clear, this is what Peter Schiff and company has been warning about.

Conclusion

So were the Austrians wrong? Not to be ambiguous, but yes and no. Yes, the Fed’s QE didn’t cause massive spikes in consumer prices. No, the Fed did hyperinflate the dollar, albeit as an accounting gimmick and by exporting those dollars abroad. Will the US economy ever see the effects of hyperinflation? That all depends on international confidence and sentiment. It also relies heavily on the warmongering neocons in Washington. If they keep badgering Russia and the rest of Eurasia, then we may see bigger and faster moves by world governments who frankly, have had enough of US hegemony. A disintegration of the European Union could also have negative impacts on the US government’s ability to keep dollars offshore. Because of the fragility of the global central banking scheme, almost any black swan could upset the apple cart. The US government’s belligerent foreign policy isn’t helping matters at all.

So no, the Austrians are right. Hyperinflation in the US is still an ever looming possibility. The timing of a hyperinflation scenario is next to impossible to predict due to the massive amount of rigging and manipulation in world markets. It seems that the laws of economics have been suspended for the time being. Many Austrians hold all things constant when they analyze an economic anomaly. They look at economic data as if there isn’t manipulation, rigging or blatant intervention into the market. In an evenly rotating economy, we would have experienced hyperinflation when the Fed began QE. But, we don’t live in an evenly rotating economy. That being said, it is only a matter of time when the power elites will no longer be able to hold back the laws of economics. When those laws go into effect, namely Say’s Law and Gresham’s Law, then this house of cards will come tumbling down. Let us hope they don’t get us into a war, worse of all a world war, in a fatal attempt to stay off the day of reckoning.

Great article. I totally agree.

LikeLike